Editor’s Note: I like to consider myself a smart person. And to be honest, sometimes I forget that I don’t know everything.

Which is why I enjoyed Marc’s piece today.

That’s not to say I don’t always love his work (Marc, I know you’re reading this!) – but this one stood out because it covers an income-generating strategy I didn’t know existed.

Turns out there are a lot of ways to make money that most people don’t know about. Which is one of the reasons Marc wrote his newest book, You Don’t Have to Drive an Uber in Retirement: How to Maintain Your Lifestyle without Getting a Job or Cutting Corners.

It’s full of unique but super-effective ways to generate new income – like peer-to-peer lending, which you’ll read about below – and maximize your savings so you can retire comfortably.

Click here to snag your copy. And if you order today, you’ll receive a free bonus chapter.

Take it from a self-proclaimed know-it-all: Marc’s book is a game changer.

– Amanda Tarlton, Assistant Managing Editor

I’ve always said there are two businesses I’d love to open: a casino and a bank. Both make tons of money.

If I opened a casino, I would have the feds at my door fairly quickly. Considering I like good food and that’s not currently a focus for the Department of Corrections, “The Lucky Lichtenfeld Casino” will have to remain a dream.

As for owning a bank? If I keep letting my dividends compound, maybe someday. But for now, I wouldn’t be able to service too many customers.

But that doesn’t mean that dream is dead.

There are various ways you can lend money to people and generate a high rate of interest. (I write about them in my new book, You Don’t Have to Drive an Uber in Retirement: How to Maintain Your Lifestyle without Getting a Job or Cutting Corners.)

One of my favorite techniques has earned me a decent annual return over the past several years.

It’s called peer-to-peer lending.

Essentially, you are the bank and you lend money to people who want to consolidate their credit cards, expand a small business, pay off a car loan, etc. But don’t worry if you don’t have $10,000 to lend to someone for debt consolidation. You can lend as little as $25 per loan.

There are several internet platforms where you can deposit money and select which borrowers you’d like to lend to. You don’t get personal information about the borrower, rather you’ll see something that looks like this:

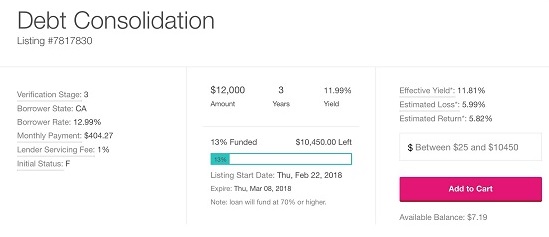

This listing is from Prosper, one of the largest peer-to-peer lending sites. The borrower is from California and is seeking a $12,000 loan for debt consolidation.

Prosper rates this borrower a B. The peer-to-peer lending sites rate the borrowers, taking into account their credit score, income and other information that any other lender would consider. As the actual lender, however, you don’t see all of that detailed information, just a range.

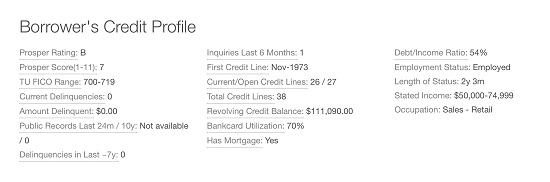

You can see that the borrower’s FICO score is between 700 and 719 and that their income is between $50,000 to $74,999, as well as other details that will help you decide if you want to lend to this borrower.

Prosper and the other peer-to-peer platforms rate their borrowers according to these variables. The higher the rating, the lower interest rate they will pay.

In this case, the borrower has Prosper’s third-highest rating (A and AA are higher) and will be paying about 12%. Someone with the lowest rating may pay as much as 35% per year. The highest-rated borrowers might pay 4% or 5%.

As the lender, 35% may be very attractive, but the risk of default is much higher.

Will I Get My Money Back?

Like any loan you’d make to a friend or your brother-in-law, the answer to the question above depends on whether the borrower repays the loan. Unfortunately, peer-to-peer platforms generally don’t do a good job of retrieving your money if the borrower stops paying.

They’ll send it into collections and try to recover your money, but good luck. You’ll probably never see it again.

That said, a default would hurt the borrower’s credit rating, as any other default would.

As with other loans, the borrower pays back interest and principal each month. The borrower sends in one payment and Prosper divvies up the funds among the lenders. Remember, lenders can lend as little as $25, so a $12,000 loan may have many participants.

I’ve had two separate experiences with Prosper.

Between 2006 and 2008, I funded 19 loans. Because that period was in the middle of the financial crisis, five loans defaulted, four of which were discharged in bankruptcy.

Due to the defaults, and after collecting interest on all the loans, I essentially broke even over those few years.

As part of an experiment, I reopened my account with $500 in September 2016. I have made 35 loans. So far, none have defaulted… but I have one that is more than 90 days late. That loan had the lowest rating and a whopping 31.5% interest rate, so it’s not a shock that the borrower is struggling. The borrower paid half the loan off when he or she stopped paying.

In the year and a half the account has been open, I’ve earned 12% on my money, which is great. But I am expecting a few defaults to lower the total. It’s imperative that you diversify the portfolio over many loans so that a few defaults won’t hurt you too badly.

Other peer-to-peer lenders include Lending Club, Upstart and Funding Circle. There are also services like Lending Robot (which I use) that automatically select loans for you based on your risk parameters and objectives.

It’s a fun way to generate some strong yields. But be careful and remember that the higher the yield, the higher the risk.

If you’ve done peer-to-peer lending, let me know how it went. Jot down your experience in the comments section below.

Good investing,

Marc

P.S. Don’t forget to check out my new book, You Don’t Have to Drive an Uber in Retirement: How to Maintain Your Lifestyle without Getting a Job or Cutting Corners. If you order today, I’ll give you a free bonus chapter on how to save money every time you visit the doctor. This chapter does not appear in the book. To order and claim your free report, simply follow the instructions here (offer expired).